Weekly Market Update

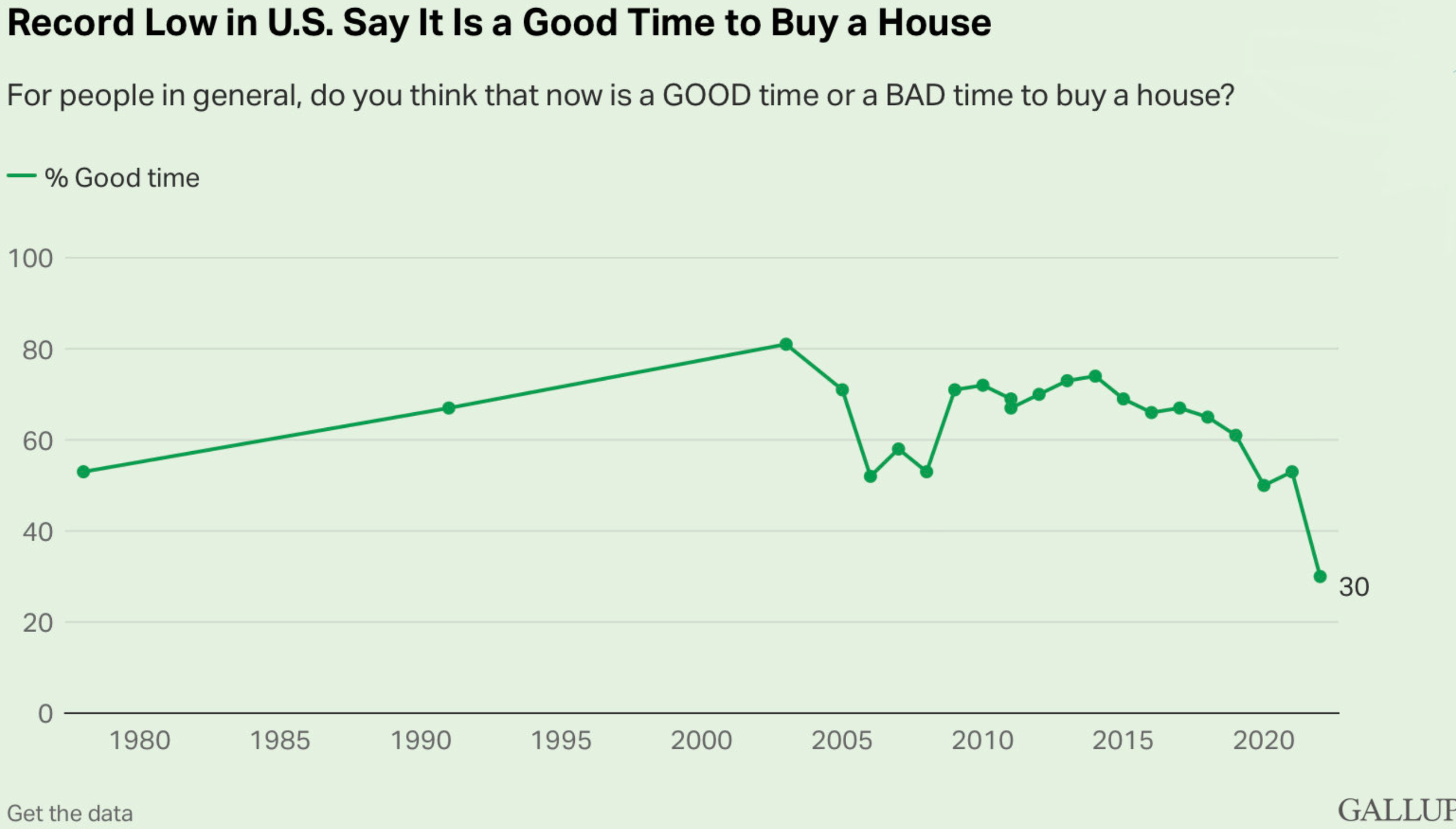

Markets briefly tipped into bear market territory on Friday as the Federal Reserve continues to create a painful period of market repricing with its attempts to stem inflation by raising rates and tamping down consumer demand. However, beyond this week’s very disappointing earnings reports from retailers such as Target, Walmart, and Ross Stores, we are starting to see some emerging signs of the Fed’s goal of demand destruction coming to fruition, particularly within big-ticket items like housing. For example, per Mortgage News Daily, the average rate on the 30-year fixed mortgage started February at 3.66%, ended March at 4.78%, and is now hovering around 5.40%. As a result, mortgage applications have plummeted and while housing prices have so far held relatively steady due to historically low levels of inventory, sales volumes of existing homes in April fell to their lowest levels since before the pandemic, while sales of new homes have declined for three consecutive months. First-time buyers have been particularly impacted as they made up just 28% of last month’s housing activity, a significant retrenchment from a longer-term average of 40% (per CNBC). In addition, consumer psychology has shifted significantly as Redfin noted homebuyer competition has fallen to its lowest levels in over a year and a recent poll from Gallup showed the percentage of consumers that think now is a good time to buy a home is at all-time lows (see chart below).

To be clear, inflation has become a broad phenomenon, but with housing/shelter being the largest component of inflation calculations at over 40% of core CPI and 30% of headline CPI, the slowdown in housing hopefully translates to a June 10th consumer price index (CPI) that is below 8% year-over-year and adds credence to the notion that inflation has finally peaked. In the meantime, we expect markets to monitor daily food and energy price movements in commodity markets for real time insights into the trajectory of inflation. Ultimately inflation has forced the Fed to tighten financial conditions at its fastest pace in decades and we suspect stock market rallies will be difficult to sustain until the Fed sees the pace of inflation moderate and provides them with cover to be less hawkish.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder