weekly market update

It was a rather uneventful week for markets, but the S&P 500 snapped a five-week winning streak as investor sentiment and positioning had become a bit overextended. Nonetheless, stocks are up roughly 4% in June and some weakness after such a strong rally is not uncommon. Since it was a quiet week for markets, we wanted to get away from market summaries and highlight some lighter topics.

HOUSING BOTTOM?

The inventory of homes for sale has long been an issue and this week we saw some very interesting crosswinds. Recent data from Redfin indicated that the number of US homes for sale fell to its lowest levels since the real estate firm started keeping records in 2012. More than 4 in 5 homeowners with mortgages have interest rates below 5% (per Redfin), so with the average 30-year fixed mortgage rate approaching 7%, homeowners are increasingly opting to stay put and housing inventory has shrunk to just 3 months of supply. However, homebuilders might be attempting to fill the void, as Tuesday’s housing starts came in at a seasonally adjusted annual rate of 1.6M units, the highest rate since April 2022, which was the highest since 2006. Whether or not this blowout housing starts figure was distorted, remains to be seen, but perhaps the housing market is indeed showing signs of bottoming.

PANAMA CANAL

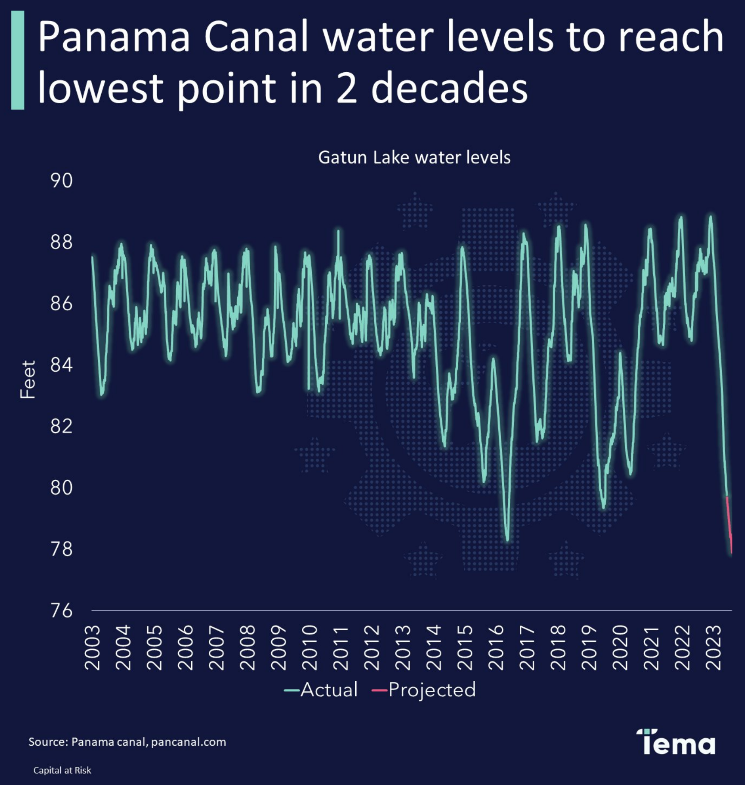

Supply chain issues borne from the pandemic have largely dissipated, but we are monitoring a severe drought that is impacting the Panama Canal, one of the world’s most important maritime routes. With water levels projected to reach their lowest levels in two decades (see chart below), Panama Canal authorities have implemented draft restrictions on vessels that can traverse this canal. As a result, some of the larger container ships might be able to carry only about half of the cargo they would typically and there could be impacts for supply chains, particularly Asia-US East Coast trade. Further complicating matters is the formation of two tropical storms, Cindy over the Atlantic Ocean, and Bret over the Caribbean Sea, so we will be watching this situation closely.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth

and our greatest compliment.