weekly market update

The disinflation narrative gained traction this week as both the consumer (CPI) and producer (PPI) price indices slowed more than expected, but stocks finished the week slightly lower as concerns around banking remained and debt ceiling talks largely stalled. Investors now expect the Federal Reserve to pause its interest rate hikes, which tends to be a bullish signal for stocks, but the S&P 500 was unable to rally as the index has largely traded sideways since the end of March. No banks failed this week, but investors remain on high alert for fallout from the Fed’s tightening cycle and PacWest Bancorp exacerbated concerns on Thursday when it revealed it had lost almost 10% of its deposits last week.

Bulls are not without talking points, however, as core CPI saw the smallest increase since August 2021 and the first quarter (Q1) S&P 500 earnings season, which is over 90% complete, has come in much better than expected. However, while the market seems to be pricing in a resolution of the debt ceiling, the closer we get to the “X-date”, or deadline at which the government can no longer pay its bills, the more investors draw comparisons to the 2011 debt ceiling event and the market volatility that accompanied it. Talks between President Biden and Congressional leaders scheduled for Friday were postponed to early next week, but some pundits actually view that as a positive, as on Thursday Congressional staff and administration officials met to discuss parameters for a deal and there is some speculation that a meeting delay gives staff more time to prepare options for lawmakers. Politicians often lack a sense of urgency to address issues until markets force their hands, so we would anticipate increased market volatility should the debt ceiling continue to remain an open issue.

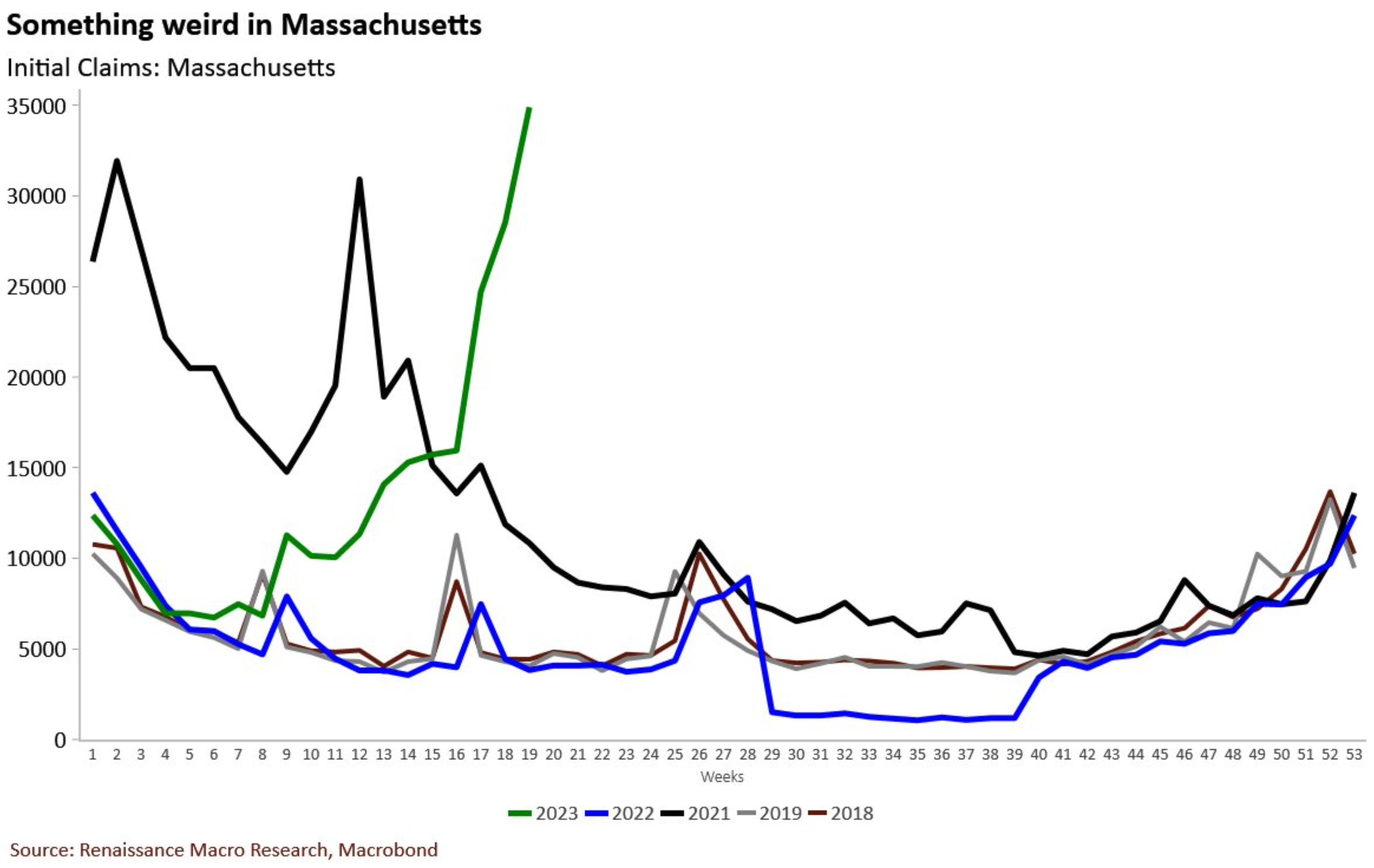

Mass Jobless Claims

Every Thursday the Labor Department reports jobless claims, or the number of Americans filing first-time unemployment claims, and this week that figure surged to 264K, its highest level since late 2021. However, the reason why jobless claims jumped caught our attention, as Massachusetts oddly accounted for 45% of the roughly 14K rise and this appears to be more than a one-week phenomenon (see chart below from Renaissance Macro). On Friday, the state attributed the rise in MA unemployment claims to fraud, which is its own issue, but we will be paying particular attention to MA jobless claims over the next few weeks.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.