WEEKLY MARKET UPDATE

The third quarter (Q3) came to an end Friday and consistent with historical trends, August and September were unfortunately difficult months for stocks as the S&P 500, while still up about 13% on the year, finished the quarter down about -2.5%. Underlying much of the recent weakness has been a notable rise in interest rates while oil prices hit their highest levels of 2023 this week and concerns around consumer resiliency have emerged. As a result, investor sentiment has declined and the S&P 500 has reached one of its most oversold levels in two decades, surpassed only by early 2022 and the pandemic lows of 2020. However, while we would like to see interest rates and energy prices show signs of fatigue, it is important to note that the setup for the fourth quarter (Q4) is rather constructive.

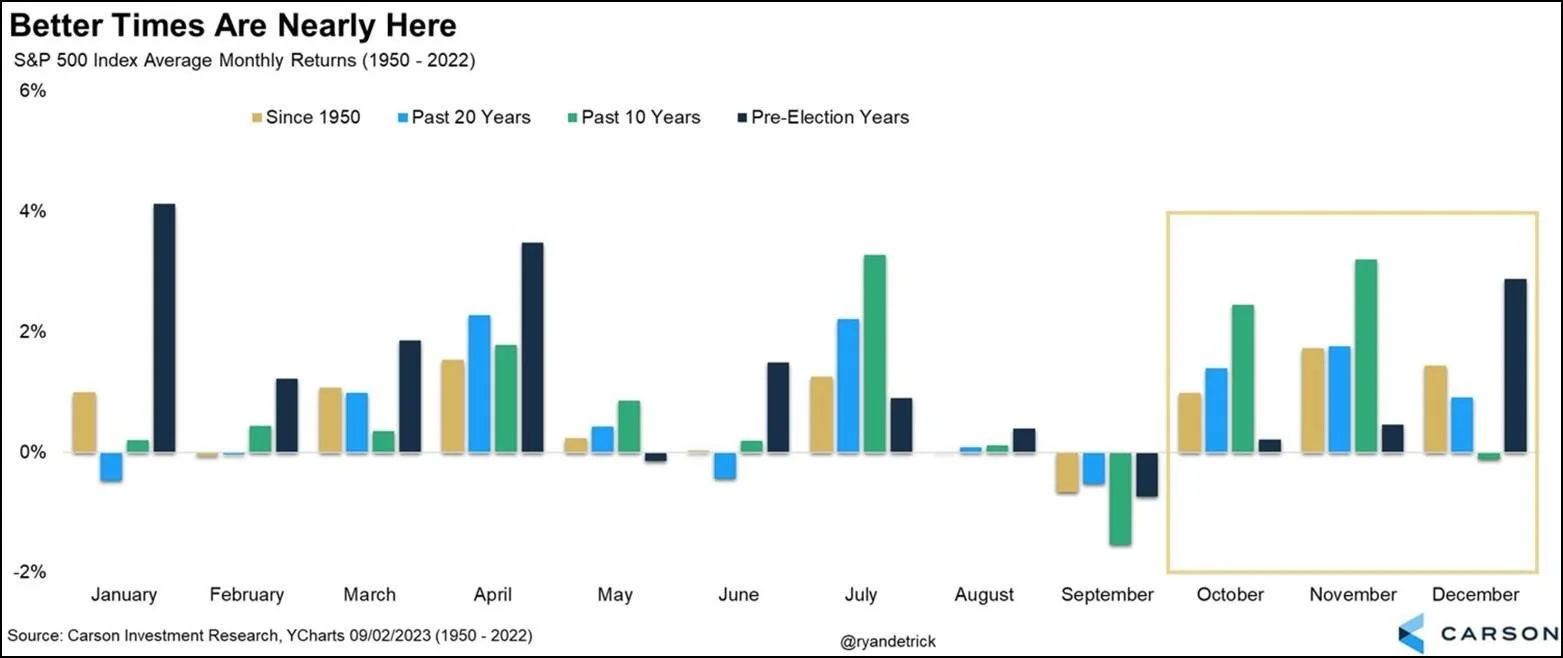

Negative seasonality received a lot of attention in September, but October, November, and December have historically been three of the best months of the year for stocks (see chart below). Over the last 20 years, for example, the Dow Jones Industrial Average (DJIA) has seen average monthly gains of 1% or more in each of these three months, with positive returns 65%, 70%, and 65% of the time (per Bespoke and FactSet). Furthermore, the last three times the S&P 500 lost at least 1% in both August and September, as it did this year, the index bounced significantly in October, rallying 8% in 2022, 8.3% in 2015, and 11% in 2011. Also, with stocks notably oversold, the odds of a material bounce are favorable as over the last 20 years, average one-month gains in the S&P 500 after entering extreme oversold territory are +2.26% vs +0.72% for all periods. Lastly, per The Market Ear, when the S&P 500 is up over 10% year-to-date entering Q4, stocks have been higher 12 of the past 13 times with an average fourth quarter gain of 6%. A government shutdown likely complicates matters as many economic data releases will be delayed, but any stabilization in interest rates and/or energy prices could be a notable catalyst for a rally and investors should be careful not to extrapolate recent weakness into the fourth quarter.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.