WEEKLY MARKET UPDATE 3/8/2024

Investors initially cheered Friday’s jobs report for February with the S&P 500 reaching new all-time highs in the morning, but stocks turned negative into the afternoon and finished the week slightly lower. Once again, the jobs report supported a “goldilocks” narrative (not too hot, not too cold) as nonfarm payrolls easily surpassed estimates (275K jobs vs. 200K consensus), but the unemployment rate rose to 3.9%, a two-year high. This might seem counterintuitive, but a rising unemployment rate supports market expectations or hopes for the Federal Reserve cutting interest rates this summer, so investors seemed to key on that during early trading. However, this market has had quite a rally, and we suspect that investors might have begun to look ahead to next week’s consumer price index (CPI) report on Tuesday.

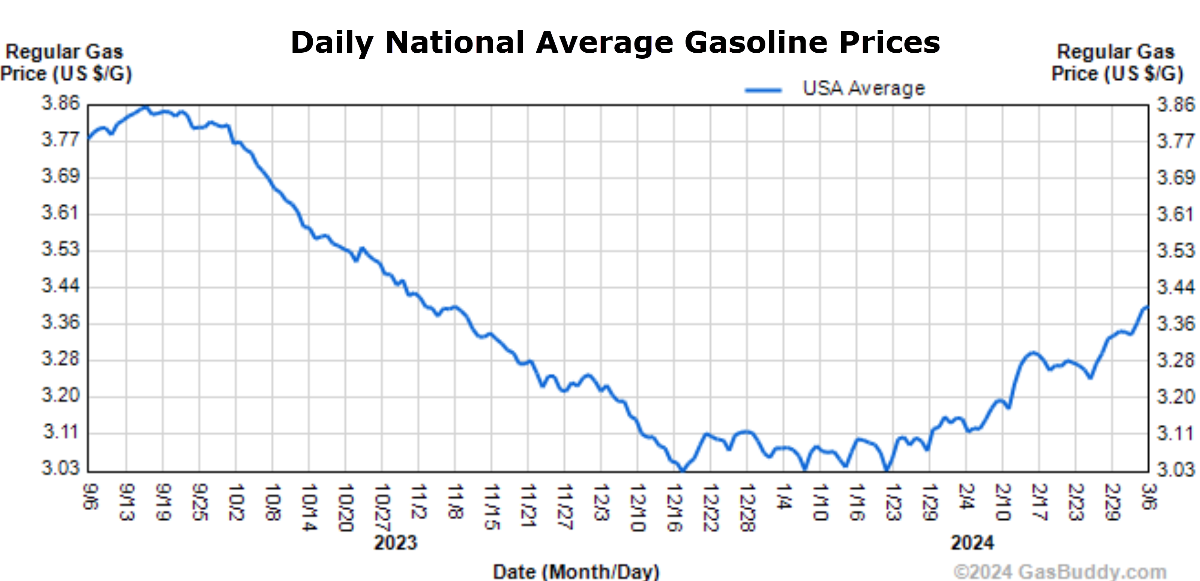

GAS PRICE HEADWINDS

Energy prices declined into the end of 2023 and helped inflation moderate, but that trend is reversing as we enter spring (see chart below). Per petroleum analysis firm GasBuddy, gas prices have risen about thirty cents since mid-January and are likely to keep climbing as March tends to coincide with refinery maintenance hitting its peak levels while gas demand increases as the days get longer. Economists are expecting headline inflation to come in at 3.7% year-over-year for Tuesday’s CPI report and after the last two reports came in hotter than expected, we will be curious to see if this rebound in gas prices is material to broader inflation figures.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.