WEEKLY MARKET UPDATE 6/21/2024

It was a fairly quiet week, particularly with the Wednesday holiday, but stocks finished higher as odds for a September rate cut from the Federal Reserve increased. With stocks near all-time highs, there is some skepticism about the Fed’s inclination to cut, but per JPMorgan, the US central bank has reduced interest rates with the S&P 500 within 2% of an all-time high, twenty times since 1980. In additional, each time this has occurred markets have responded favorably. All twenty instances have seen the S&P 500 higher a year later with an average return of nearly 14%. Next week markets will be headlined by the presidential debate and Friday’s release of the Fed’s preferred gauge for inflation, the PCE.

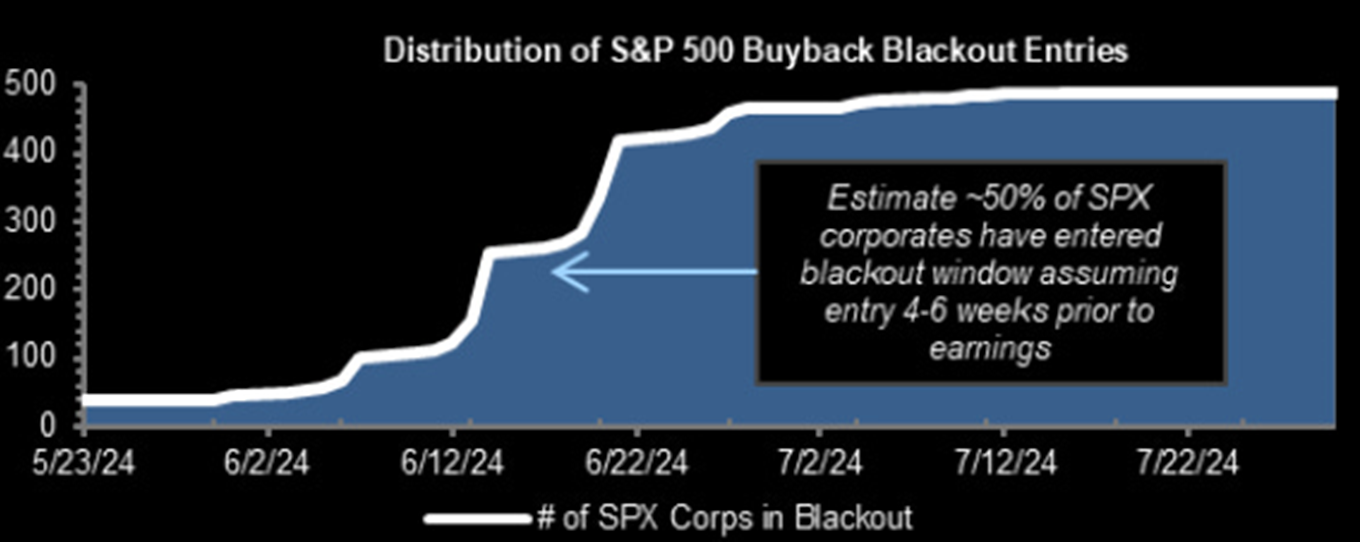

BUYBACK BLACKOUT

As the second quarter earnings season approaches there will be an interesting tug of war for stocks. On the one hand, seasonal tailwinds are strong with the S&P 500 finishing July higher nine straight years and the two-week period to start July, the strongest of any of the year (per FactSet).

On the other hand, as companies approach their earnings release dates, they enter buyback blackout periods and can no longer repurchase their shares, removing a significant source of equity inflows. For example, Goldman Sachs expects $925B in S&P 500 corporate buybacks this year and Bank of America noted that client buybacks last week were third largest in company history since 2010. Buyback blackout periods are short-term in nature, but until late July (see Goldman chart below) a big buyer of stocks will be sidelined.

_____________________________________________

PEDDOCK TAX SERVICES ACQUIRES GEORGE KAPLAN, P.C.

Peddock Capital Advisors, LLC and our sister company, Peddock Tax Services, LLC are pleased to announce that on June 21, 2024, Peddock Tax acquired the firm of George Kaplan, PC, Certified Public Accountants, established in 1990.

This acquisition will further expand our accounting and tax expertise and will enhance our ability to serve you.

The entire Peddock Tax Services team will continue to be located at 40 Salem Street, Building #1, Suite 7, Lynnfield, Massachusetts.

_____________________________________________

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment