WEEKLY MARKET UPDATE 9/13/2024

It was another volatile week for markets, but the S&P 500 was able to claw back nearly all of last week's over 4% decline as investors prepared for the September 18th Federal Reserve policy announcements. Wednesday was a particularly wild day of trading as the S&P 500 and the Nasdaq Composite initially responded to the morning’s slightly hotter-than-expected consumer price index (CPI) by both falling over -1% before reversing into the afternoon and closing the day up over +1%. Interestingly, the last time the Nasdaq achieved such a feat was in October 2022 and a day after the bear stock market lows. We expect elevated market volatility to continue through the November elections, but next week all eyes will be on the Fed and their interest rate announcements on Wednesday.

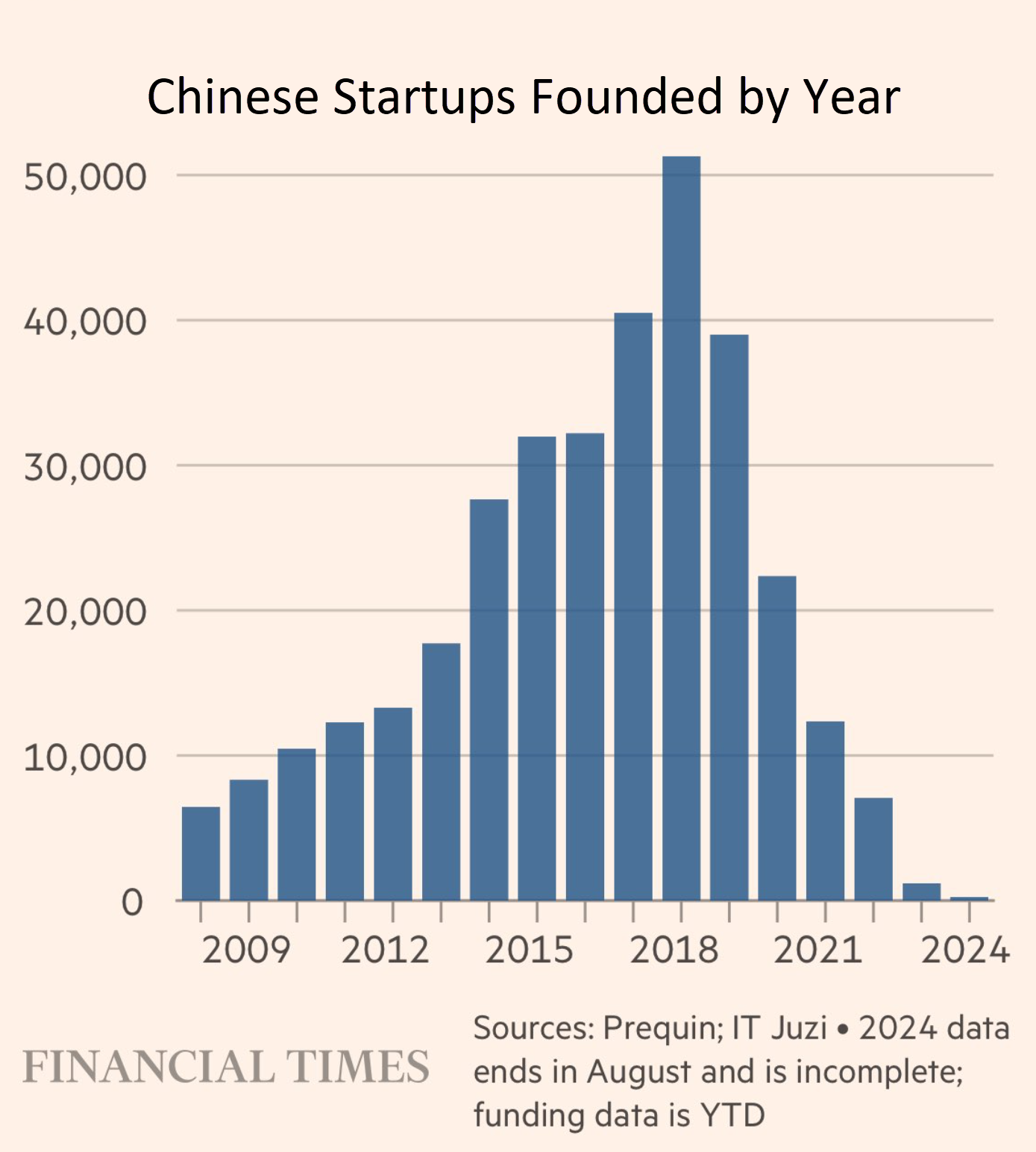

CHINESE ENTREPRENEURIAL WINTER

The world’s second largest economy has been in a pronounced economic slowdown and while the country’s issues around consumer spending and real estate are well documented, we found a recent report out of the Financial Times to be particularly eye opening. Simply put, the Chinese private sector is contracting at an incredible pace (see chart below). Per data provider IT Juzi, over 51,000 Chinese start-ups were founded in 2018 and that number is on pace to fall to less than 1,200 this year, an over 95% decline! Perhaps Beijing can reinvigorate its economy, but without a vibrant private sector, we believe Chinese policymakers will be fighting an uphill battle.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.