WEEKLY MARKET UPDATE

Stocks rose over 2% on the week, but while Wednesday’s consumer price index (CPI) stole the show, there were several other reasons for the S&P 500 ending the week less than 7% below all-time closing highs. To be clear, this week’s strong results probably do not happen without the CPI report for June coming in at 3% headline inflation year-over-year, below expectations, and down from 4% the prior month. However, soft-landing expectations, or the belief that the Fed can engineer a cyclical slowdown in economic growth that avoids recession, have also been buoyed by last Friday’s goldilocks jobs report coupled with this week’s consumer sentiment survey that came in at the highest levels since September 2021. In addition, early results from the second quarter earnings season, that unofficially kicked off on Friday, have been encouraging with important companies such as JPMorgan, Citigroup, Wells Fargo, Delta, Pepsi, and UnitedHealth all beating expectations and raising guidance. Next week S&P 500 earnings season will heat up and be headlined by Bank of America, IBM, Tesla, and Johnson & Johnson to name a few.

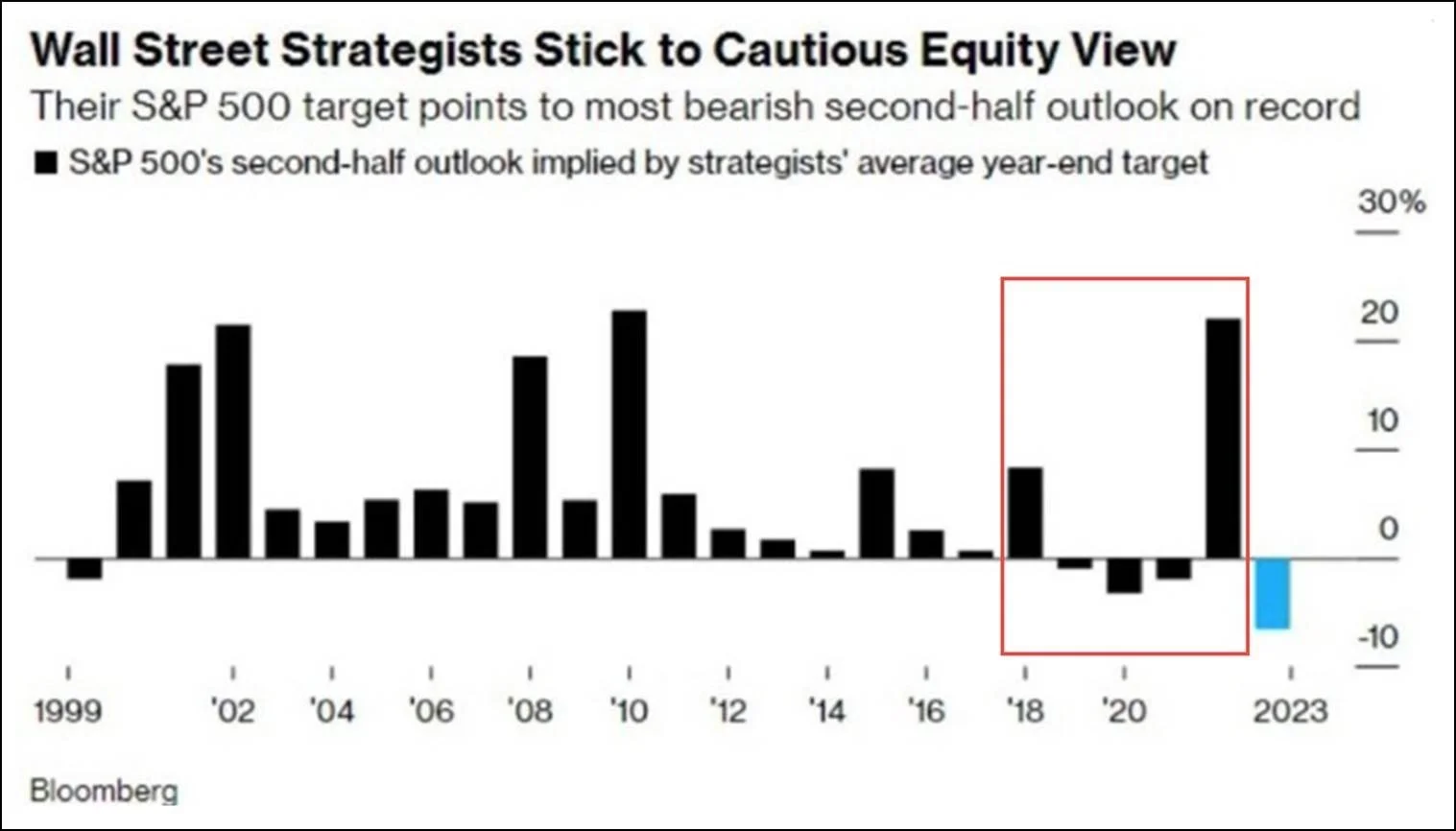

“SMART” MONEY INDEED

Wall Street often refers to itself as “smart money”, implying some sort of innate investment advantage, but recently we came across a chart that puts a dent into that view. Below, Bloomberg has plotted the implied second-half outlooks from Wall Street based off their yearend S&P 500 targets. Going back five years and starting with 2018, the average Wall Street strategist predicted about 10% upside in the second half, guess what the S&P 500 did? It fell almost -8%. In 2019, 2020, 2021, Wall Street forecast negative second half returns, but the S&P 500 saw double digit second half gains of +10%, +21%, +11%! For 2022, Wall Street at least got the direction correct as their average price targets implied over 20% gains in the second half and the S&P 500 rose a whopping +1.4% over that period (per data from FactSet). If recent history continues, that negative 2023 second half expectation is perhaps a gift from Wall Street.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.