weekly market update

Stocks finished higher for the eighth of the last ten weeks as the S&P 500 continues to grind higher. However, the Dow Jones Industrial Average, which was up only about 5% versus almost 17% from the S&P 500 over the first six months of the year, was a notable outperformer as it closed higher for a tenth straight day, a feat that last occurred in 2017. Entering the second half of 2023, we highlighted how stock market gains had become unusually concentrated around the “Magnificent Seven”, or the mega caps - Apple, Microsoft, Alphabet, Meta, Amazon, Tesla, and Nvidia, which constitute roughly 26% of the S&P 500 but generated 73% of the S&P 500’s first half returns (per Bank of America). However, the number of stocks participating in the rally has begun to broaden significantly in July as the first half laggards, such as the financial, utilities, and energy sectors have all outperformed the S&P 500 over the last three weeks, as have the small and mid-cap US stocks. Next week will be headlined by the Federal Reserve likely raising interest rates another 25 basis points on Wednesday and a busy week of second quarter earnings season releases.

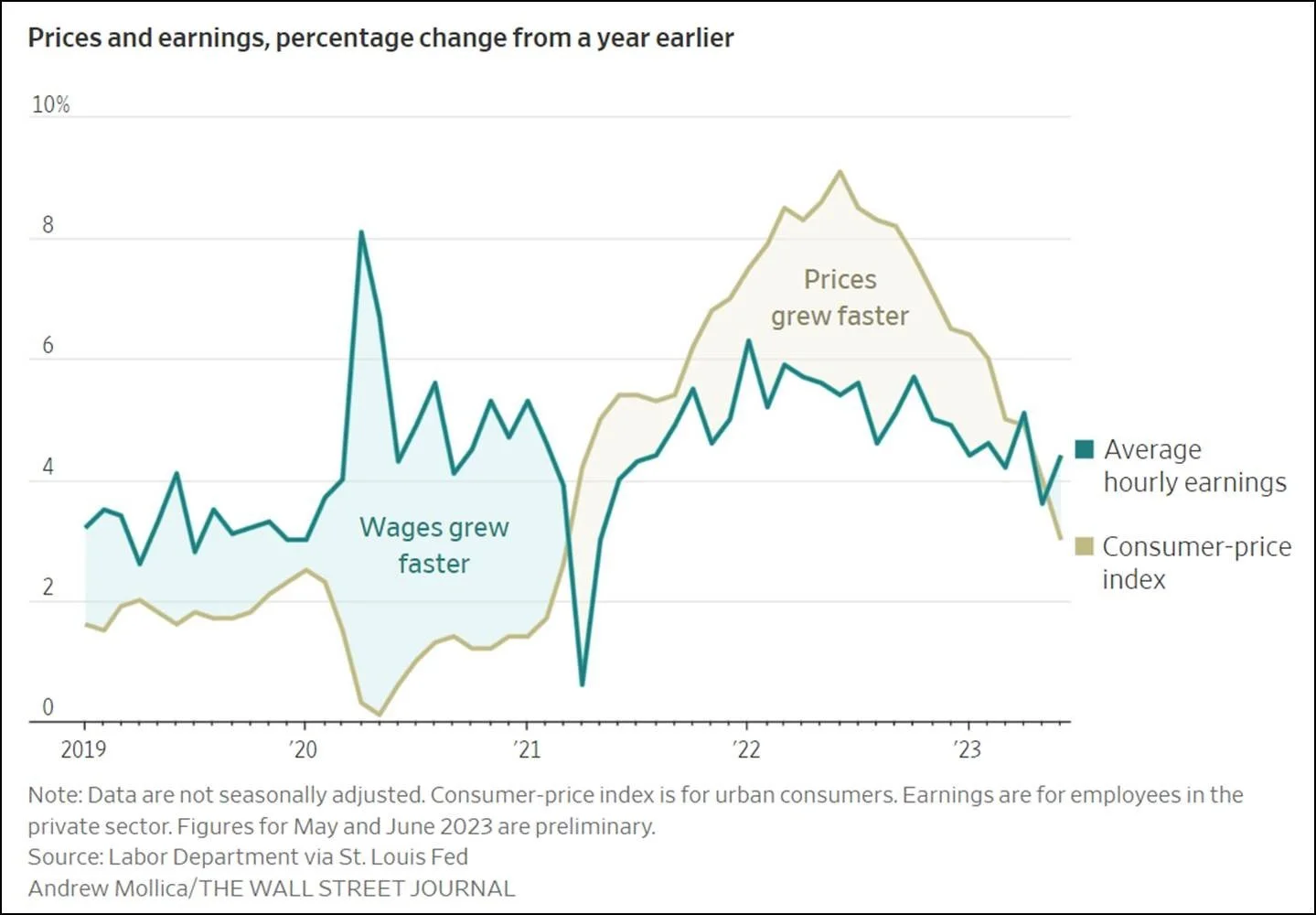

POSITIVE REAL WAGES

“It’s great to see wage increases, particularly for people at the lower end of the income spectrum…But we want that as part of the process of getting inflation back down to 2%, which benefits everyone.”

~ Jerome Powell, June 14 Press Conference ~

Starting in May, American wage growth surpassed inflation for the first time in two years (see chart below). In June for example, average hourly earnings rose 4.4% year-over-year while headline inflation, as measured by the consumer price index (CPI), came in at 3%. As a result, real wages, or wages adjusted for inflation, have turned positive and while this is a great development for workers, this could potentially complicate the Federal Reserve’s efforts to rein in inflation if real wage growth translates to increased consumer spending. Therefore, next week’s press conference with Fed Chair Jerome Powell that follows Wednesday’s 2PM Fed meeting announcements, will be watched particularly closely for indications of how positive real wages might factor into future Fed decisions.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.