Weekly market update 4/12/2024

It was a tough week for stocks as Wednesday’s hot CPI report rattled markets and growing geopolitical tensions between Iran and Israel caused a risk-off trade heading into the weekend. Also potentially pressuring stocks is a seasonal liquidity drain due to the approaching April 15th tax deadline, particularly after a strong 2023 for stock market returns. The March CPI report only came in 0.1% hotter than expected, but it was the fourth consecutive month of higher-than-expected data so fears of persistently high inflation grew and undermined hopes of the Federal Reserve cutting interest rates in June. Inflation had been largely ignored by investors in the first quarter, but with hot data extending into the spring we expect the personal consumption expenditures (PCE) report, the Fed’s preferred gauge for inflation, to be particularly important to markets.

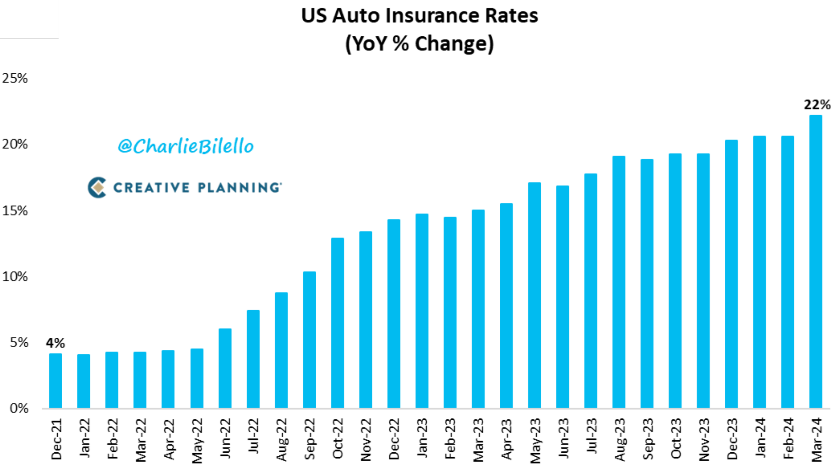

AUTO INSURANCE INFLATION

Driving much of the hotter than expected March CPI report was a little discussed culprit - auto insurance. On a year-over-year basis, car insurance rose 22.2% (see chart below), which per Forbes, is the biggest one-year spike since the 1970s. This surge in insurance rates is due to a variety of factors such as historically high new and used vehicle prices, mechanic wage increases, supply chain shortages, and the fact that over 40% of the cost of a new car is now electronics and semiconductors (per Deloitte). It is worth noting that the personal consumption expenditures (PCE) report on April 26th calculates auto insurance differently than the CPI, PCE is net of claims paid out, but if you have not looked at your auto insurance premiums lately, you might want to be sitting down when you do.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.