WEEKLY MARKET UPDATE 5/10/2024

It was a quiet week for economic data and earnings releases, but after declining over -4% in April, the S&P 500 registered its third consecutive week of gains and headed into the weekend less than 1% below the all-time highs achieved in late March. Next week will be busier, but investors will be particularly focused on Wednesday’s consumer price index (CPI) for April as well as earning releases from retail giants Home Depot (5/14) and Walmart (5/16).

DEATH OF A LEGEND

“I did a lot of math. I made a lot of money, and I gave almost all of it away. That's the story of my life."

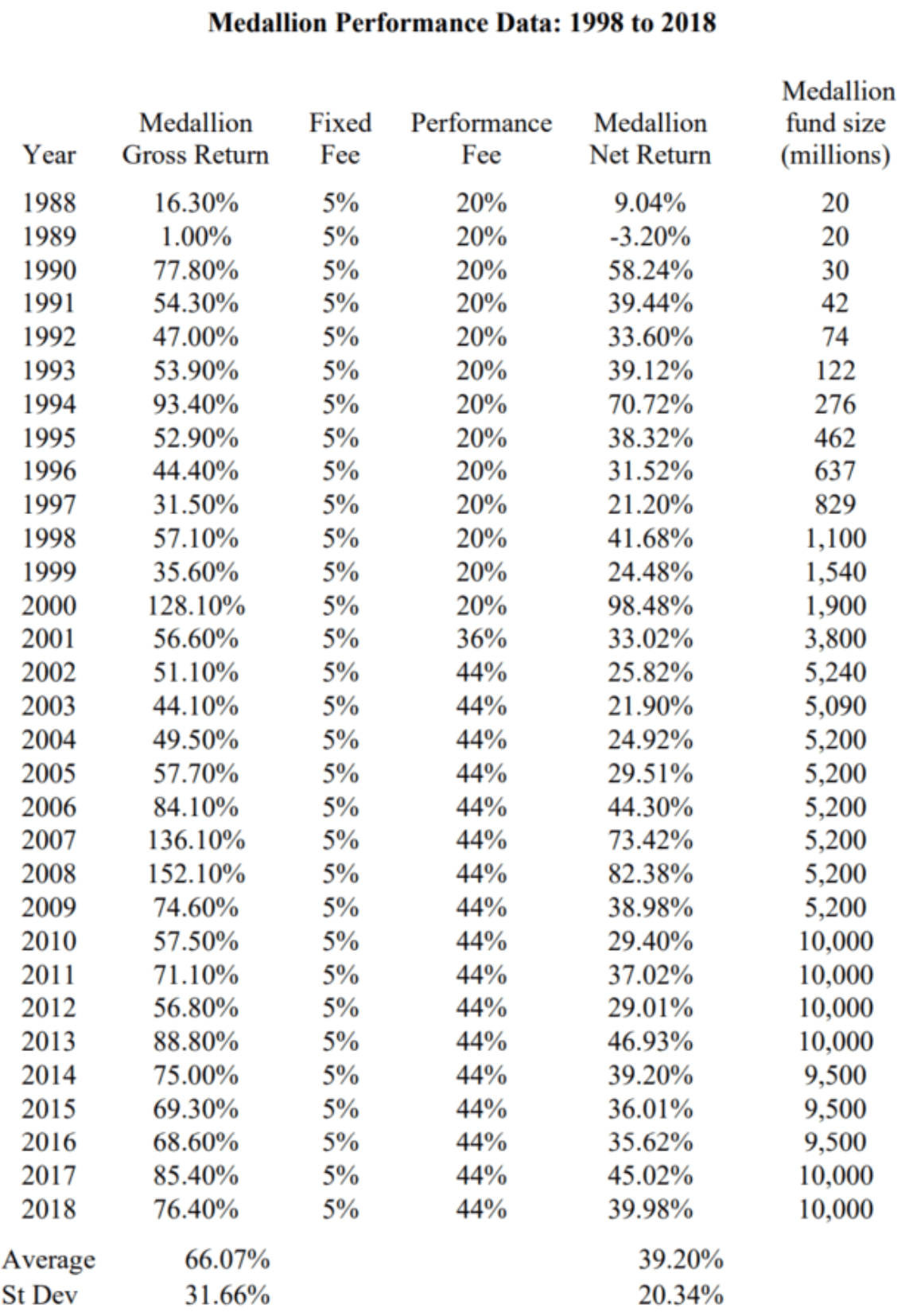

Jim Simons, a mathematics prodigy who would go on to become a pioneer of quantitative trading and arguably the greatest investor of all-time, passed away Friday at the age of 86. Born in Newton MA, Mr. Simons received a bachelor’s degree in mathematics from MIT before achieving a PhD from Berkeley. Initially Simons worked in academia, teaching at Harvard and MIT, before trying his hand as a code breaker for the NSA. However, around the age of 40, Simons pursued a career in trading and would go on to become the founder of hedge fund Renaissance Technologies LLC in 1982. Leveraging algorithmic trading and quantitative strategies, Renaissance’s flagship Medallion Fund produced incredible returns that trumped other famous investors such as Warren Buffet, Peter Lynch, or George Soros. For example, between 1988 and 2018, the fund saw an average annual return of 66% before fees (see table below). A legion of other hedge funds has since attempted to replicate the success of Mr. Simons, but it is unlikely that we ever see this level of success again.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.