Weekly Market update 5/17/2024

The S&P 500 eclipsed 5,300 for the first time as Wednesday’s consumer price index (CPI) indicated the lowest year-over-year core inflation in three years (3.6%). Renewed disinflation was cheered by investors as signs of inflation reheating had previously roiled markets in April and the S&P 500 has now finished higher four consecutive weeks. Also, a distinct “bad news is good news” narrative has emerged, as investors have embraced a slowing labor market and deteriorating retail sales data as encouraging signs that inflation can continue to moderate. Next week will be headlined by Nvidia reporting earnings, the release of minutes from the Federal Reserve’s last meeting, and consumer sentiment/inflation expectations.

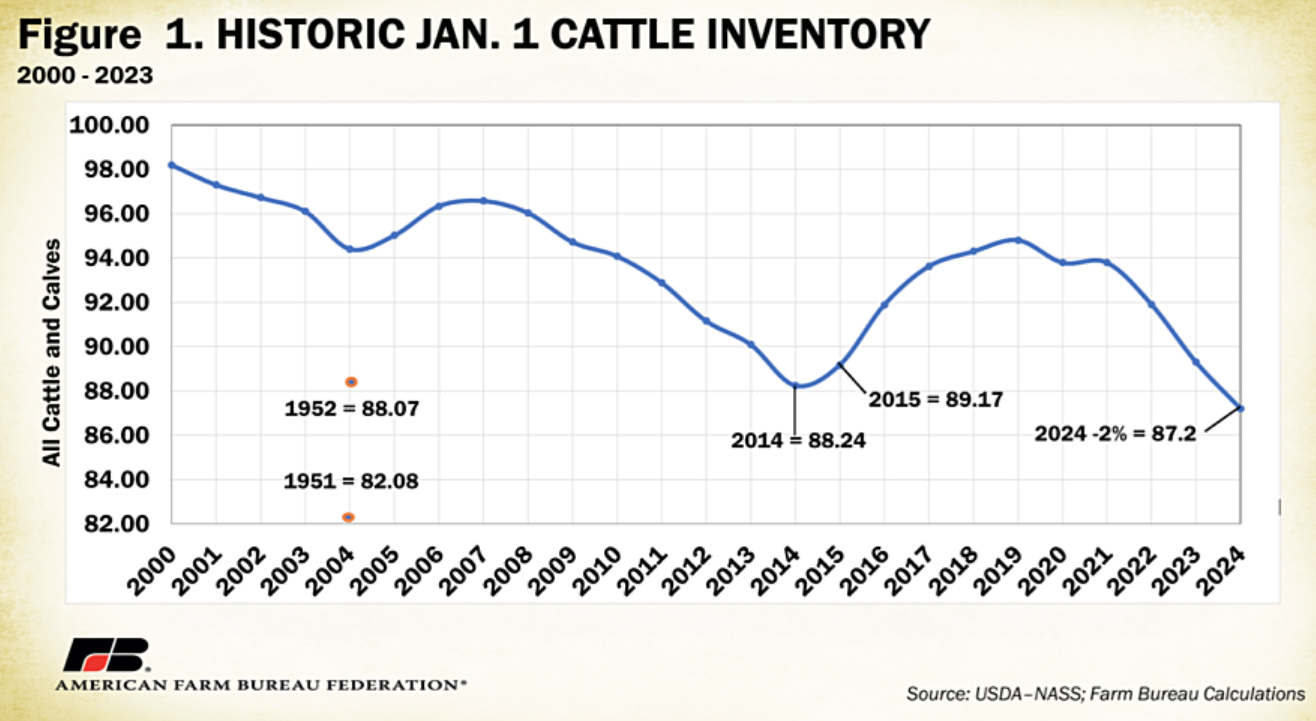

WHERE’S THE BEEF?

Per the recent CPI report, month-over-month grocery prices fell in April for the first time in twelve months, but as cookout season approaches beef prices are notably moving higher. Beset by high feed costs (grains) and drought, US ranchers have offloaded cattle so significantly that recent cattle inventory or herds, have dropped to their lowest levels in 73 years (per USDA data). As a result, beef prices have surged to record highs. Unfortunately, herds are not expected to rebound for at least a year or two, so perhaps “Where’s the beef?” has new relevance.

Ian G. Browning, CFA

Managing Director, Investment Strategies | Shareholder

Thanks to our clients and friends who have referred business to us over the years.

Your endorsement has been the cornerstone of our growth and our greatest compliment.